Mobiloans is the instant home credit mini cash loan or personal loan provider to the real needy in the fast loan system. It is the opportunity for those who cannot bare high-interest rate and fees for just home credit loan 10000 ($145). But in Mobiloans you borrow money and pay back mobiloans without any hefty overdraft fees. Mobiloans is the emergency cash immediately apply system which allows the person to get the loan on time, so in this way, the worth of the loan is always there in Mobiloans.

Before you apply for Mobiloans, you need to know what the Costs of Mobiloans line of credit are. It is very important you have the information about the fees, rate and other costs of emergency money provider Mobiloans. So read the rates carefully which will sure you that at what amount you will return your loan to mobiloans.

COST INFORMATION OF MOBILOANS (FEES, RATE AND OTHER COST)

Contents

1#. APR – Annual Percentage Rate (on Mobiloans Credit Advances): 206.14% – 442.31%

It is based on the credit amount and available payment billing cycle with maximum numbers.

Example of APR:

APR Formula = [(Total fees/Avg. Principal Balance)/Number of Billing Cycles] * Billing Cycles per year * 100

| Line of Credit Amount | Number of Billing Cycles | Total Fees | APR % | Rewards Level – Diamond APR% |

| $200 | 13 | $230 | 442.31% | 154.81% |

| $1000 | 25 | $1600 | 320.00% | 112.00% |

| $1300 | 38 | $2879 | 295.28% | 103.35% |

| $1500 | 50 | $4010 | 272.58% | 95.40% |

| $2500 | 60 | $6045 | 206.14% | 72.15% |

IMPORTANT NOTE FOR THE ABOVE TABLE

Number of the Billing cycle (1 billing cycle = approximately 14 days or 26 per year)

Cash Advance and Fixed Finance Fees in Total Fees

No Rewards discount on APR %

Cash advance fees and fixed finance charges are reduced to 65%, visit www.mobiloans.com/rewards for how to qualify information.

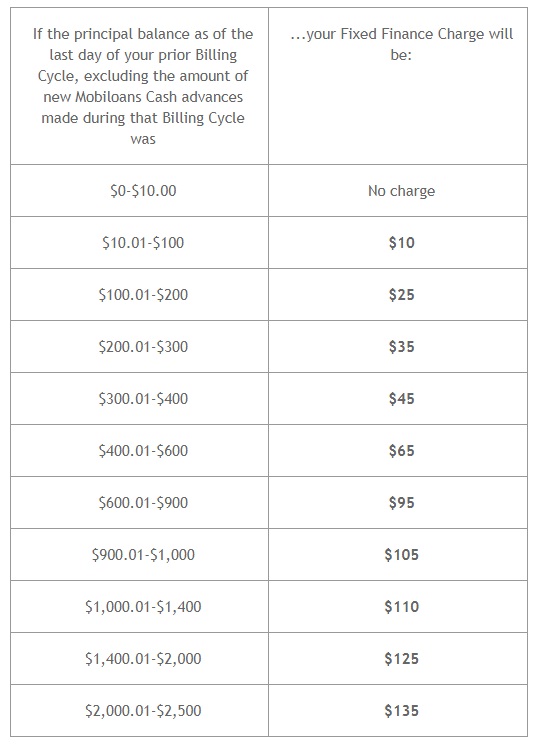

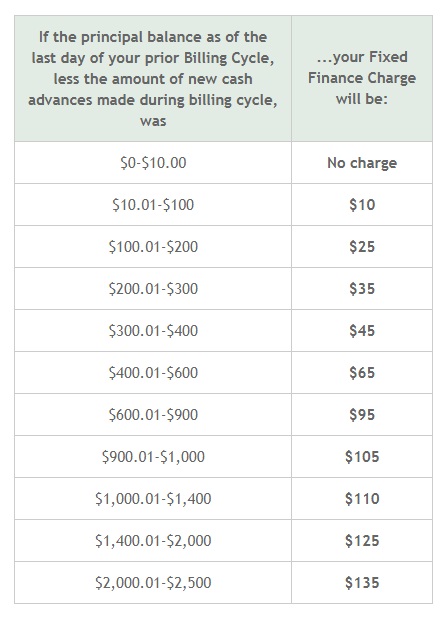

2#. Fixed Finance Charges:

In this rate of the chart, the charges of every billing cycle would be fixed.

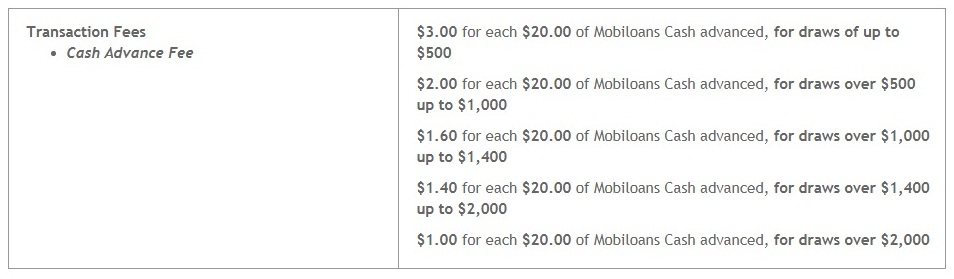

3#. Transaction Fees and Cash Advance Fee:

Type of Charge In Mobiloans

There are two types of charges in Mobiloans for loan receiver where he/she can easily return with no more charges.

1#. Cash Advance Fee:

In this charges loan receiver is charged for on-time per draw, the best example you can see in the below chart of draw amount against cash advance fee.

In this way, during the first billing period (approx 2 weeks) if the loan receiver pays off a line of credits it will charge for Cash Advance Fee only.

2#. Fixed Finance Charge:

In this type, the charges applied on the unpaid balance on each billing cycle and the benefit is that the billing cycle is that loan receiver can get a loan for more than one billing cycle. You can see the below chare as an example to understand more clearly about Fixed Finance charge of Mobiloans.

How TO Apply For Mobiloans

You can easily apply for a cash loan in 1 hour without any further waiting; if your documents are not accurate then the system will take time in order to complete the loan process.

Step#1. Open the Mobiloans URL in the internet browser.

Step#2. Click on “Apply Now” button located at the top right on the screen.

Step#3. You are now into the Mobiloans Apply foam page; there are four stages to complete your loan foam.

1) Create Your Account: name, DOB, Emil ID, SOR.

2) Personal Information: contact detail, family member, more

3) Financial Information: bank detail, salary info.

4) Submit Application: loan related final checking.

Follow the instruction and enter the information to the provided field. Also, note that you need to click on the acknowledgement of Mobiloans.

Step#4. You will be informed through your provided personal information which means that your loan has been sanction and now you will be receiving the home credit mini cash in your bank account.

How To Login Mobiloans Account

Step#1. Go to the Mobiloans official page and click on the “Log In” purple button located at the top right of your screen.

Step#2. You will popup instant login page at the side which it asked the email address and password in order to access your Mobiloans account.

Step#3. Once you click on the login button you will be entering your Mobiloans account where you can manage your account.

How To Reset Mobiloans Password

There are many reasons that you forget your password but it is easier to recover your mobiloans password. `

Step#1. To reset your password go to the login page of mobiloans.

Step#2. You will see the “Forgot your password?” below remember my email address, click on it.

Step#3. You are now in forgot your password page where it will ask your email address and click on “continue” button, email id which you enter during registration.

Step#4. The email will be sent to your provided email id where you will be given the link to reset your password and some security question for the safety of your account.

What is the eligibility of Mobiloans?

There are some criteria of Mobiloans which help for the successful applicant for a loan and need to be confirmed by the mobiloans.

- Loan receiver must be at least 18 years old or above.

- Loan receivers have the proper source of income such as employed or register a business

- Loan receiver has the proper resident in an eligible state

- The account of the loan receiver should not subject to garnishment or not frozen.

- Never default on Mobiloans line of credit.

Finally:

Mobiloans is the elastic loans system which provides the credit without the card with the 24 hours a day service, so any person can apply for the loan. There are some terms and condition we discuss and also mention the steps of how to apply, log in for Mobiloans. If you are really needed of money then you should try Mobiloans service in order to get a less charged return. Any question related to this topic or some help during registration can be asked through the comment section.

Online casino

Online casino